How to Set SMART Financial Goals + Examples (2024)

As a Certified Financial Therapist, it’s painfully clear that having examples of SMART financial goals are vital for reaching all of your goals. Because every goal you have requires financial support.

Have you ever considered that? Almost every life decision you make has a financial component to it.

Which is exactly why it’s so important to make clear financial goals for you and your family. Obviously, I’m a big fan of setting financial goals. I’m an even bigger fan of setting SMARTer financial goals.

What are SMART Financial Goals?

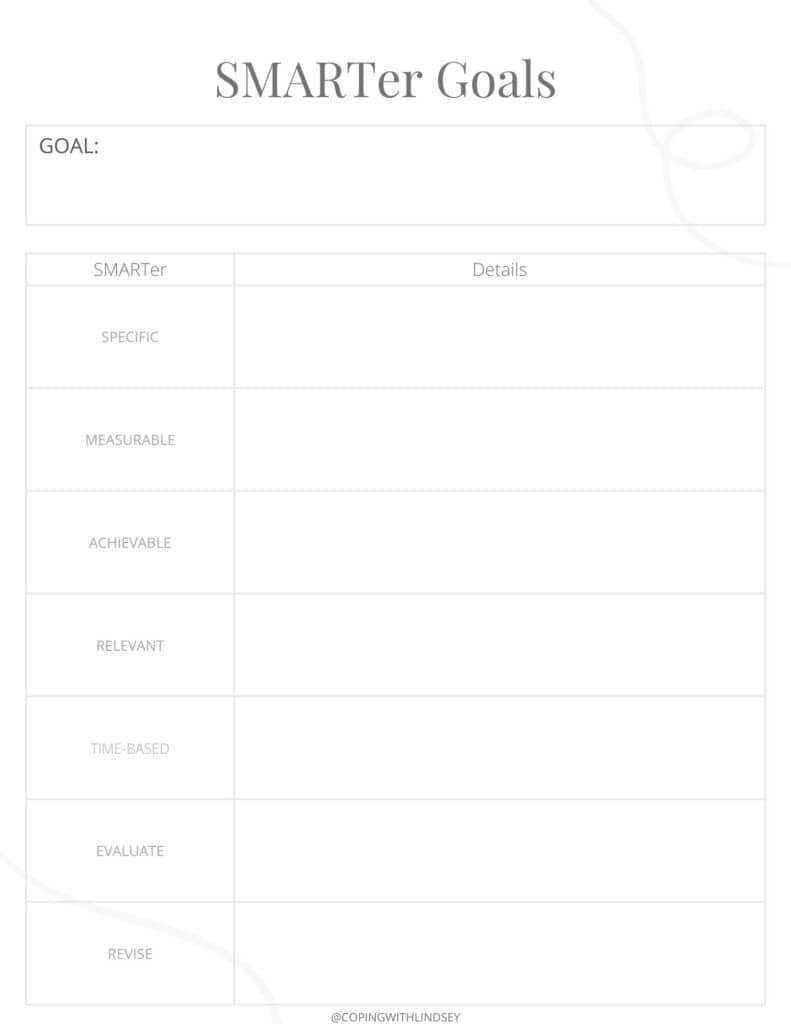

If you haven’t heard of SMART goals, welcome to the gold mine of goal setting. SMART is an acronym that stands for specific, measurable, achievable, relevant, and time-based.

Without these key details, financial goals are just words without a plan. But using the components of SMART goals will help take the gold out of the mind.

This table gives you more detail about each component of SMART financial goals:

| Specific | Be ultra-clear about what your financial goal is and leave no room for vagueness. |

| Measurable | Have the ability to quantify or appraise your financial goal as an indicator of progress. |

| Achievable | Make your financial goal reasonable and doable. |

| Relevant | Your financial goal should align with your money values. |

| Time-Based | Define a start and end time of when your financial goal will be accomplished. |

Make SMART Financial Goals SMART-er

SMART goals were first developed by George Doran and others in an 1981 article. And while SMART goals were a great place to start, the -er, evaluate and revise, has since been added to make SMART financial goals even SMART-er.

| Evaluate | Assess and reflect on the progress of your financial goal. |

| Revise | Make any necessary adjustments to your financial goal. |

The evaluation and revision of any policy, procedure, or goal is necessary to *actually* accomplish what you set out to do in the first place.

Think about it 🤔

In previous circumstances, how many times have you done the work of setting a goal, but not followed through?

Or, how many times has your place of work implemented a new policy, but soon enough, it fell off the rails because no one assessed how the new policy was going?

The evaluation and revision of financial goals, especially as the timeline on the goal gets longer, is imperative for success.

Benefits of SMART-er Financial Goals

There are some lofty benefits of setting SMART-er financial goals including:

- Provides clarity for decision

- Gives actionable steps in the right direction

- Helps set standards and expectations

- Increases likelihood of accomplishing goals

- Allows you to measure your progress

Drawbacks of SMART-er Financial Goals

As with anything, there are a couple drawbacks of SMART-er financial goals, which are:

- Might be too rigid

- Lacks flexibility

Examples of SMARTer Financial Goals

There are three basic examples of SMART-er financial goals: Short-term, medium-term, and long-term.

- Short-term SMART-er financial goals are any goals you want to accomplish within 3 years.

- Medium-term SMART-er financial goals have a time stamp of 3-10 years.

- Long-term SMART-er financial goals are any goals that will take longer than 10 years to accomplish.

As I stated above, all goals have a financial component to them. Thereby, all goals are, in some way, a financial goal.

But for sake of ease, let’s look at three examples for short-term, medium-term, and long-term SMARTer financial goals.

Short-Term SMART-er Financial Goals

As we talked about above, short-term SMART-er financial goals include anything you want to accomplish between now and the next three years.

Here are three examples of short-term financial goals using the SMART-er goal template:

Short-Term SMART-er Financial Goals: Example 1

This person saw my Money Map and decided they wanted to have an emergency fund for life’s tough moments. Security is one of their core money values.

Certified Financial Therapist Tip: When setting a SMART-er financial goal, attach the goal to a broader money value of yours (i.e. security, opportunity, flexibility, safety, etc.) to make the goal more meaningful.

They calculated their bare bones budget (including housing, food, transportation, and other necessary bills) for one month’s worth of expenses.

It’s generally recommended you have 3-6 months of your bare bones budget saved in a fully-funded emergency fund. This person chose four months for their magic emergency fund number.

Let’s look at how they created a SMART-er goal for building an emergency fund 👇🏼

Build an Emergency Fund

| Specific | Fully fund my emergency fund of $20,000 (4-months of my bare bones budget) in a high-yield savings account within 30-months. |

| Measurable | As I get paid bi-weekly (26 paychecks per year), I will automatically transfer $308 into my high-yield savings account for the next 65 paychecks. |

| Achievable | After crunching the numbers, I can spare $308 per paycheck to my emergency fund without going into credit card debt for other purchases. |

| Relevant | As security is one of my core money values, having a fully-funded emergency fund aligns with my desire for comfort and safety. |

| Time-Based | I’ll fully-fund this high-yield savings account in 2-and-a-half years. |

| Evaluate | I’ll review my budget every 4-weeks during my monthly money date to make sure $308 per paycheck is still doable. |

| Revise | If during my monthly money date, I realize I want or need to adjust my savings rate, I will do so. Also, if I get that promotion I applied for, I will save my extra income aggressively until I reach my goal of $20,000. |

Short-Term SMART-er Financial Goals: Example 2

After experiencing some of life’s hardships, this woman’s credit score drastically decreased. Now, she’s determined to build her credit score. Her bigger “why” is independence.

Here’s more context:

She’s hoping to buy a new car. But because her credit score is so low, she currently needs her dad to co-sign on the loan. As she’s a 28-year-old woman, she doesn’t want to have to rely on anyone for a co-signature.

Thereby, her short-term financial goal is to increase her credit score, and ultimately, not need a co-signer. This is how she’s going to do it 👇🏼

Increase My Credit Score

| Specific | I will increase my credit score by 150 points within 15-months by focusing on credit utilization, asking for higher credit limits, and setting balance alerts. I will also be asking my employer for a raise soon, with hopes my debt-to-income ratio benefits my credit score. |

| Measurable | I will check my credit score every three months through Credit Karma, a free credit report site. |

| Achievable | As my credit score is currently 520, and I’m striving to reach a score of 670, this is a doable task. |

| Relevant | Independence is what I’m after, and having a higher credit score will decrease my need for a co-signer. Thus, this goal is relevant to me! |

| Time-Based | I will secure the increase to “good credit” within 15-months. |

| Evaluate | Every 3 months, when I check Credit Karma, I will assess if my credit score is going up. |

| Revise | If my credit score is on the right trajectory, I will not make any adjustments. If, however, I plateau or my score decreases, I will revise my current plan. |

Short-Term SMART-er Financial Goals: Example 3

This mom has noticed that every month she’s questioning where all her money is going. Even though her family’s salary is $125,000, she can’t seem to get ahead.

Upon further investigation, she’s notices her spending habits are a tad out-of-control.

She values setting a good example for her daughters and wants to teach them good financial self-care. It’s clear she needs to get a handle on her spending so that her daughters have a good money role model.

This is the example of her short-term SMART-er financial goal 👇🏼

Stop Recklessly Spending Money

| Specific | I will stop recklessly spending money on things I don’t *actually* care about by being more intentional with my spending habits within the next 6-months. |

| Measurable | First, I’ll use this Expense Tracker to identify where I’m spending my money and how I’m feeling about each purchase. After tracking my purchases and feelings for a month, I will identify the problem areas. I’ll continue to use Expense Tracker for 6-months. At the end of each month, I’ll measure if my feelings towards my expenditures have become more positive. I’ll also measure how much I have spent by calculating my total amount spent at the end of each month. |

| Achievable | As I am clearly over-spending, I can certainly make better, more intentional choices. I know I won’t get it right every time, but I’m willing and committed to becoming more intentional with my spending habits. I can do this! |

| Relevant | I really care about transforming my relationship with money so I can model good spending habits for my daughters. This is very important to me! |

| Time-Based | I want my spending habits to be consistently intentional within 6-months. |

| Evaluate | I will use the Expense Tracker and evaluate my spending habits and feelings on the last day of each month. Throughout the next several months, I’ll be looking for improved intentionality and generally positive emotions associated with my purchases. I will also evaluate how much money I’m spending each month. |

| Revise | After evaluating my expenses, I will continue to be more mindful of my spending habits. When I need more support, I will contact Lindsey about working with her for financial coaching. |

Medium-Term SMART-er Financial Goals

Generally, medium-term SMART-er financial goals are important, but not urgent as they will be accomplished in 3-10 years.

This often includes savings goals such as planning a wedding (even before you’re engaged), moving across the county, vacations, new cars, and more.

These are actual examples of medium-term financial goals that my clients have had. Let’s look the examples for how they’ll achieve they’re SMART-er goals!

Medium-Term SMART-er Financial Goals: Example 1

This couple has two kids under two, and they haven’t taken a vacation (just the two of them) since their honeymoon, 4 years ago.

They value their marriage and want to celebrate big milestones like anniversaries. They also love to travel to warm destinations.

Taking an epic 10-year anniversary vacation is their medium-term goal. Let’s see how they can be SMART-er about it 👇🏼

Take an Epic Anniversary Vacation to Mexico

| Specific | We’re going to take a weeks luxury vacation to an all-inclusive resort in Mexico for our 10-year anniversary, which is in 6 years. We’ll need $10,000 for this amazing vacation. |

| Measurable | We’re starting with $1,000 in our high-yield savings account (HYSA) with a 4% interest rate. We will automatically deposit $110 per month ($55 per paycheck) in the HYSA. Using a savings calculator, we will have $10,205 in 6 years! |

| Achievable | We can definitely save $55 per paycheck to make this happen! |

| Relevant | As time to nurture our marriage and traveling are values that we hold, this is a very relevant goal! |

| Time-Based | We have 6 years to save the $10,000! |

| Evaluate | Every 6-months we will make sure our calculations are correct. |

| Revise | If our interest rate percentage goes down or we need the extra $110 one month, we will adjust allocations as needed! |

Medium-Term SMARTer Financial Goals: Example 2

This dad loves his current truck. And though he takes great care of it, he knows it won’t last forever. He wants to be prepare to buy his next used vehicle in cash.

He does a lot of DIY housework and landscaping and tows his boat, so he wants another truck to maintain his lifestyle.

He’s savvy enough to know that he doesn’t need a brand new vehicle. Something used will suffice. He needs to save $32,000 in 4.5 years. This is his plan 👇🏼

Buy a New (Used) Truck

| Specific | I will pay for a new (used) truck in cash 4 and a half years (54 months). |

| Measurable | Given that I’ll be able to sell my current truck for at least $8,000, and I don’t want to spend more than $40,000 on my next vehicle, I’ll need to save $600 per month (300 per paycheck) in a HYSA. |

| Achievable | After reviewing other expenses, I’ll need to make trade-offs for my saving goal including: ▪️Lower my monthly “gifts” budget from $100 to $50. ▪️Go to a less expensive barber ($70 to $35). ▪️Lower my monthly payment to the vet (0% interest rate). Then, once that bill is paid, I will put extra money toward my savings. Doing these three things will allow me to save $600 per month. |

| Relevant | This goal not only serves my lifestyle but keeps my family in a safe vehicle! |

| Time-Based | I have 4.5 years to reach my goal of saving $32,000. |

| Evaluate | I’ll review my savings plan every month. |

| Revise | I’m planning to keep this going for 4.5 years, but when I pay off my vet bill, I could potentially add more to my savings goal. I’ll revise monthly, as needed. |

Medium-Term SMART-er Financial Goals: Example 3

This mom has $68,000 in student loans. As the interest is 6%, it’s teetering on being considered “high-interest debt.” She wants this debt gone!

When she learned that student loan payments resume in October of 2024, she became really anxious, but she turned that anxiety into action. She made a plan to be debt-free in 10 years

It’s about more than being debt-free. It’s about having opportunity and options, flexibility and freedom. Here is an example of how to be debt-free in 10 years 👇🏼

Be Debt-Free in 10 Years.

| Specific | I will use the snowball debt pay-off method to become debt-free (except for my mortgage with a 2.5% interest rate) in 10 years. |

| Measurable | Using the snowball method, I’ll pay off the debt with the lowest balance, while paying the minimum balance on all other debts. I’ll use my momentum to crush the next lowest balance, and so on. I’ll keep a close eye on my finances by reviewing my Spending Plan every two weeks. |

| Achievable | After listing all my high-interest debt and reviewing all other expenses, I can afford to make progress on my debt pay off. I can be debt-free in 10 years! |

| Relevant | My debt feels restricting. And I’m determined to have options and opportunities. This is a very relevant goal! |

| Time-Based | I’ll pay off my debt in ten years (120 months). |

| Evaluate | I’ll review my Spending Plan every other Friday (pay day), after the kids go to bed, and assess my pay off plan. |

| Revise | As I move through my pay-off plan, I will edit as needed. |

Related read: 40 Ways to Practice Financial Self-Care in 2024

Long-Term SMART-er Financial Goals

Having long-term goals (anything more than 10 years away), can be challenging because it seems too far off to really matter.

But the truth is, long-term financial goals are some of the best to have. You’re going to want to stop working some day. Even if some day is 30 years away.

Certified Financial Therapist Tip: My favorite way to accomplish long-term financial goals is to automate as much as possible.

Long-Term SMART-er Financial Goals: Example 1

This person is currently 30-years-old and has the goal to retire comfortably at age 60. For her, “comfortable” means living off of $80,000 annually, which she estimated based on her current salary.

Based on family history and average age of living, she estimates she’ll live until 85 years old. This means her “magic number” for retirement by age 60 is $2.5 million.

This is how she’s going to get there 👇🏼

Retire Comfortably at 60-Years-Old

| Specific | I want to retire in 30 years (at age 60) with $2.5 million, so I can live until 85-years-old and budget for $100,000 per year in expenses. In order to do that, I’ll invest $500 per month in my Roth IRA. Assuming a 7% interest rate, I’ll have about $614,000. I’ll also invest $1,500 per month into my 401(k). With a 7% interest rate and compounding interest working in my favor, I’ll earn just over $1,842,000. ($614,000 + 1,842,000 = $2,456,000.) While returns are not guaranteed, I feel comfortable with this being my retirement fund! |

| Measurable | As I’ll invest this money in the stock market to gain wealth, I’ll measure my growth every 6-months. Compounding interest will help me! |

| Achievable | As I grow in my career, earning promotions and raises, I’ll increase my savings rate. I have run the numbers, and investing a total of $2,000 in very doable, while still giving me plenty of income for fixed and variable expenses. |

| Relevant | I want to stop working one day, so this is a relevant goal! |

| Time-Based | I have 30 years to accomplish this goal. |

| Evaluate | As I’m a long-term investor, I’ll limit how often I check my retirement account balances to once every 6-months. |

| Revise | Unless increasing my savings rate, I’ll stay the course of investing through both bear and bull markets. In 20 years, I’ll re-allocate my stock options to less risky investments. But otherwise, there will be little revision! |

Long-Term SMART-er Financial Goals: Example 2

For many parents, a long-term SMART-er financial goal is to help their kids. As with all financial goals, that can mean different things for different people.

In this example of a long-term financial goal, the parents are hoping to gift their two children $50,000 each by the time they turn 18.

Their eldest child is 8-years-old and their second is 6-years-old. This means they have 10 years and 12 years, respectively, to invest.

They’ve also made the decision to not designate this money to a certain purchase (i.e. it’s not exclusively for college payments, a wedding fund, or any other specified event.). It’s simply a gift.

Let’s look at how they can do it 👇🏼

Gift Our Kids $50,000

| Specific | We want to give both of our children $50,000 when they turn 18-years-old, no strings attached. |

| Measurable | I will automatically contribute and invest $150 per paycheck (for ten years) into Child 1 UGMA and $115 per paycheck (for twelve years) into Child 2 UGMA. (Child 2 has more time, so we need to invest a smaller amount each month.) |

| Achievable | Because this is long-term investing, we’re assuming a 7% interest rate and used an investment calculator to calculate the numbers (including estimated compounding interest). It’s within our budget to allocate a total of $265 per paycheck towards our kids financial future. |

| Relevant | We want to help our kids financially, so this is relevant to our money values! |

| Time-Based | As our kids are 8-years-old and 6-years-old, we’ll be contributing to their UGMAs for 10 years and 12 years, respectively. Once they become legal adults, we’ll stop contributing to their UGMAs. |

| Evaluate | We’ll assess our stock options every 6 months to ensure we’re still happy with the asset allocation. |

| Revise | Unless increasing our savings rate, we’ll keep consistently investing in a diversified EFT. |

Long-Term SMARTer Financial Goals: Example 3

This couple recently learned they are expecting their first baby! They value education, and want to help their child with rising college costs.

The couple knows they may not be able to afford the entire college tuition, but figure any amount will be helpful.

Given the recent changes to 529 Plans, these parents feel comfortable opening this type of investment account for their baby.

As the baby is not born yet, they’ll start by putting $150 per month in a high-yield savings account, yielding a 4% interest rate. When the baby is born and has a social security number, they’ll open the 529 plan and start funding that.

Here’s the example of this SMARTer financial goal 👇🏼

Saving for Kid’s Higher Education

| Specific | We’ll save $150 per month in a 529 Plan for our baby. Until our baby is born and has a social security number (SSN), we’ll start saving $150 per month in a HYSA. In 9 months, we’ll have saved $1,350. Then, we’ll open the 529 account and invest the initial $1,350 and automatically transfer and invest $150 monthly. |

| Measurable | We don’t have an exact number that we’re trying to reach, as we are more focused on investing for our retirement. However, we can justify investing $150 per month for this baby. We will have contributed $34,200 in 19 years. But with an assumed 7% interest rate, we will have just over $71,000 in their 529 plan. That’s a good start! |

| Acheviable | We’ll use auto-pay to make the investments each month, which is doable for our growing family. |

| Relevant | We value education and want to help our baby with college expenses, so this is exciting and relevant to us! |

| Time-Based | We’ll have about 19 years until we can decide how our child wants to use their funds! |

| Evaluate | We have monthly money dates where we review all expenses, savings, and investments. We’ll evaluate our positions then. |

| Revise | We plan to have all of this automated, so it’s easy and out-of-sight. However, when we get raises or other life circumstances come up, we’ll decide if we can contribute more or less to the 529 plan! |

SMART-er Financial Goals Template (PDF)

Click here to create your own examples of SMART-er Financial Goals with this template 👇🏼

The Wrap-Up: How to Set SMART-er Financial Goals + Examples

You can use the acronym, SMART-er (specific, measurable, achievable, relevant, time-based, evaluate, and revise) to accomplish all your goals, not just financial. Because remember, all goals have a financial component.

The above SMART-er financial goal examples are just that, examples. Your financial goals can be anything you want. And that’s the key.

Your SMART-er financial goals have to be something you care about. Not what other people or the society at large say you should care about. So often we get hung up on the “shoulds” of life.

Your parents say you should buy a house.

Society says you should want a brand new car.

TikTok says you should have this bucket hat.

Forget that. You should buy only what brings your joy and fulfillment. Attaching a core value or belief to your goals will help steer you in the right direction and act as your North Star.

Read next: How to Transform Your Relationship With Money: 5 Tips from a Financial Therapist (2023)