How to Negotiate Medical Bills: 3 Easy Steps

Today, my friend, you are going to learn how to negotiate a medical bill. And yes, you can negotiate medical bills even after insurance has paid on them.

After birthing Koko, insurance paid 85% of the bill. I still had an out of pocket expense of just under $2,500. I negotiated that medical bill down another 20%, saving us an additional $500 in less than 10 minutes.

These three easy steps can help you do the same:

- Make sure your bill is correct,

- Check insurance coverage (if you have it), and

- Negotiate the medical bill

The whole breakdown is below 👇🏻

You can also listen to today’s episode of Financial Self-Care with Financial Therapist, Lindsey on Apple Podcasts, Spotify, or wherever you like to listen!

American Healthcare System

There is a much, much larger conversation to be had about our healthcare system. People often say our medical system is broken, but journalist and author of Never Pay the First Bill, Marshall Allen says, “Our health care system is not broken. It was made this way.”

Unarguably, America is run on consumerism. And that consumerism doesn’t stop at healthcare. In fact, it’s amplified by our health care system.

In the United States, our health care spending grew 4.1% in 2022, reaching $4.5 trillion. That means Americans are now spending an average of over $13,000 per person each year on health care.

As far as our nation’s Gross Domestic Product, health spending accounted for 17.3% in 2022. If you’re unfamiliar, Gross Domestic Product, or GDP, is a measure of a country’s economic activity that calculates the total value of the United State’s final goods and services produced.

And 17.3% being spent on health is a large portion of the GDP. It’s especially large when we start looking at other country’s economic spending.

U.S. Healthcare System Compared to Other Countries

The OECD, or Organisation for Economic Co-operation and Development, is an international organization that conducts independent analyses and stats on world economics and social well-being.

They ran a global analysis of GDPs around the world. (So what the other countries are spending their money on.) I was interested in health expenditures as a percentage of Gross Domestic Product across various nations.

In 2023, 16.5% of the United States’ GDP went to health expenditures, which is the highest in the world. The second highest on the list was France and their health expenditures were only 11.9% of their overall GDP.

For your reference, here’s a couple other comparable countries: Japan spent 11.4% of their GDP on health expenditures. The United Kingdom spent 10.9%, South Africa spent 8.3%, and Norway spent 7.9%.

American Healthcare System Explained

It goes without saying, but this is a macro issue. And it’s extraordinarily complicated because, as with most macro problems, there needs to be a macro solution. But you, the individual, is being directly impacted on a day-to-day, micro basis.

So why is this happening and what can you do about it?

Well, we’ve been taught to trust nurses and doctors, and we should be able to trust nurses and doctors. But you have to remember that our healthcare system isn’t just made up of nurses and doctors.

There are administrators, pharmaceutical companies, board of directors including powerful financial influencers, and many more people, along with your location, insurance contractual agreements, and other factors that determine your cost of health care.

Have you ever wondered how your health care prices are decided? How clinics know whether or not to charge $50 for an office visit or $500?

It’s unlikely that you’ve ever really considered it. Because we’ve been conditioned to just fall into line with how our medical system is set up.

American Healthcare System Problems

But the way we pay for health care is ass backward from how we pay for everything else in America.

Imagine going to a Starbucks, ordering a hazelnut latte, not paying for that latte, drinking the latte, and receiving a bill weeks later for $60.

The itemized statement reads:

$5.00 for coffee

$5.00 for milk

$6.00 for each pump of hazelnut

$10.00 for an in-store purchase fee

$10.00 fee for each barista that helped make your drink

And an extra $10.00 because the barista that called out your name wasn’t covered under your barista fee at that location.

It’s absolutely ludicrous to think of that happening. But that’s exactly how our medical system’s billing is structured.

One of the biggest problems we see with America’s healthcare system is how the more dire the situation, the more financially screwed you are.

You barely know how much a scheduled appointment is going to cost, much less a visit to the emergency room.

PRICE Transparency Act

There have been some initiative’s to make hospital pricing more available like the federal government mandating price transparency with the Health Care PRICE Transparency Act, which started in January of 2021.

The Health Care PRICE Transparency Act requires hospitals to provide clear, pricing information online in two ways:

- As a comprehensive machine-readable file with all items and services.

- In a display of shoppable services in a consumer-friendly format.services they provide in two ways:

I’ve taken the time to find these clear and accessible pricing, and let me tell you, those aren’t the words I would use to describe when trying to find pricing information.

It’s usually buried in some weird tab on their site, if at all. While doing the research for this episode, I’m still left scratching my head on a few websites, unable to find anything about how much services cost.

Even still if you’re in the middle of an emergency, are you going to take the time to look up the various prices associated with all the possible interventions associated with said emergency? Probably not.

Think of it a different way.

Imagine your beloved home goes up in flames. Thankfully your family gets out, but you watch from the curb as your house is burning.

The fire department arrives, but before trying to extinguish the blazing fire, you have to sign an agreement that says you will pay for the service.

You have absolutely no idea the cost.

The clipboard in your hands says, “Sign here to take financial responsibility.”

Meanwhile, your belongings are ablaze. Pictures you cherish. The sweater your grandfather wore; the only physical piece of him you have left. Cookbooks with family recipes, that are written nowhere else but in your burning home flash through your mind.

You’re vulnerable and, of course, you sign on the dotted line. In that moment, you’d do anything to stop the damage.

Turns out, the fire department is a for-profit entity that now charges you to extinguish your burning home.

I think we can all agree, that would be wrong. That would be predatory. And yet, that’s how our healthcare system is set up.

The more vulnerable you are – the more urgent your need – the less you know about cost and the higher the price tag.

Bankruptcy for Medical Debt

This is why medical debt is the number one leading cause of bankruptcy in America. Most people wrongly associate bankruptcy with financial irresponsibility, but that’s not the case at all. Insane medical bills are the primary reason someone files bankruptcy here in The States.

According to a 2024 report, “People in the United States owe at least $220 billion in medical debt. Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000.”

Yet, it’s considered normal for how we received health care services. Again, as Marshall Allen says, “Our health care system is not broken. It was made this way.”

While out paddleboarding together, my daughter was bitten by a mosquito on her eyelid. Her face blew up like a Thanksgiving Day parade balloon.

After trying normal remedies like ice and benadryl, hours later the swelling was only getting worse.

If it was any other body part, I probably would have just let it run its course. But it was her eye. And all I could think was, “What if there’s a bigger issue here? What if she goes blind and it’s my fault because I didn’t take her into Urgent Care?”

Reluctantly, I brought her in. Like all other doctors appointments, we were asked to wait in the lobby until the doctor could see us.

After two hours of waiting, we were finally seen… for less than 5 minutes. The doctor assured us that the angry swelling was normal. She offered an ointment, which the doc made clear wasn’t necessary, but an option nonetheless. And without any intervention – albeit a small amount of peace was restored to my nervous system – we were on our merry way back home.

Fast forward a few weeks later, I received a bill in the mail for nearly $350.

You bet your butt I disputed that charge. Because we were billed for a much higher level of care than we received.

Determining Healthcare Prices

Part of the problem – and what many people don’t know – is there are different levels of care, which, of course, all have different price tags associated with it.

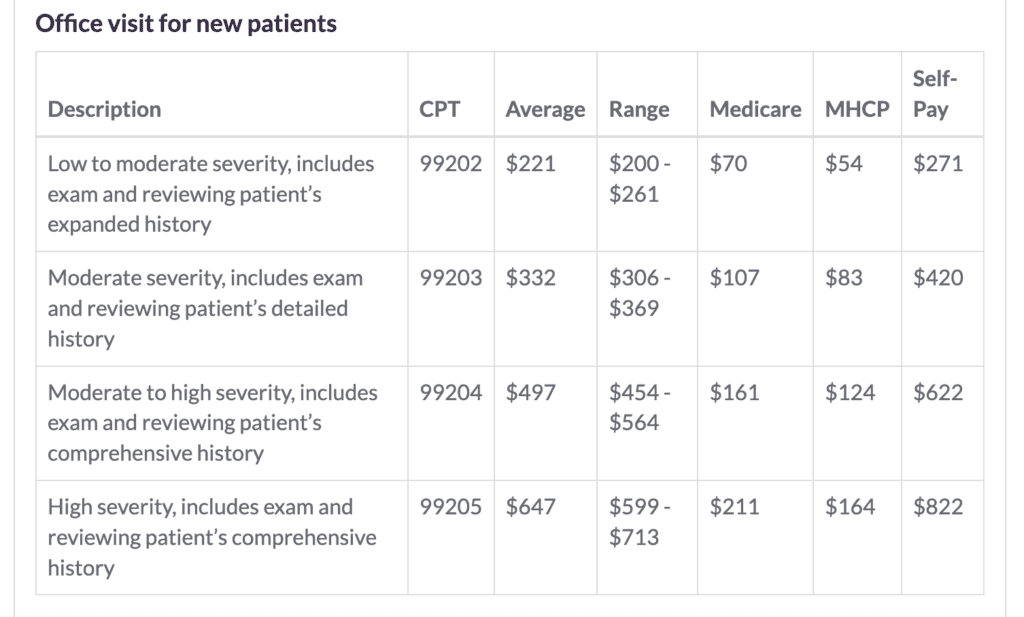

For example, I looked up a local hospital system and after some searching, I finally found their listed prices for an office visit. At this particular hospital – and this is true for many hospitals – there are five levels of care for an office visit.

The first reads: Minimal problem, may not require a physician. The average cost for a “Minimal Problem Office Visit” is $70, with a range of $65-$79.

The second: Limited or minor problem, includes exam and reviewing patient’s history. The average cost for a “Limited or Minor Problem Office Visit” is $161, with the range of $156-$172.

The third: Low to moderate severity, includes exam and reviewing patient’s expanded history. The average costs for a “Low to Moderate Severity Office Visit” is $258, with a range of $249-$274.

The fourth: Moderate to high severity, includes exam and reviewing patient’s detailed history. The average cost for a “Moderate to High Severity Office Visit” is $367, with a range of $$352-$387.

And finally, the fifth: Moderate to high severity, includes exam and reviewing patient’s comprehensive history. The average cost of a “Moderate to High Severity Office Visit” is $509, with a range of $492-$542.

The problem is, these descriptions are quite vague, with much left for interpretation.

Kinsley was seen for less than 5 minutes for her mosquito bite, and it probably could have been checked by a triage nurse.

The level of care should have been recorded as a level one: Minimal Problem. But we were billed for a level four: Moderate to high severity office visit, which cost $300 more than the level of care provided.

These levels of care are supposed to be objective with precise guidelines on cost of care. But they simply aren’t.

It is subjective and incongruent.

I’m one person. I cannot change policies with the snap of my finger. And I sure as hell can’t change our medical system by myself. But what I can do is negotiate my medical bills. Lesson the burden on me and my family. And negotiate a fair price for services.

Why You Need to Negotiate Medical Bills

Negotiating medical bills–even just the word negotiating–gives some people the heebie jeebies. It can be really intimidating to think about having to negotiate anything. And I can understand that.

The word negotiation usually implies some sort of confrontation, which we tend to avoid like the plague. But, because I’m a financial therapist, I want you to reframe the way you think about negotiations.

Instead of negotiation being synonymous with conflict, confrontation or a powertrip, think of negotiation as a fair agreement with each person or entity coming out with a win.

You’re not negotiating anything to be an asshole, you’re negotiating a medical bill for fairness.

Remember towards the beginning of this post, I asked, “Have you ever wondered how your health care prices are decided? How clinics know whether or not to charge $50 for an office visit or $500?”

Well the truth is, pricing is also subjective. There is no set price for any one medical service, even something standard like a mammogram.

According to GoodRX, the price of a mammogram can cost anywhere from $286 to $549. The craziest part is that differences can be seen at clinics merely 20 minutes away from each other.

This isn’t one of those situations like mammograms in New York City, a place with an extremely high cost of living, cost far more than a mammogram in rural South Dakota. No. These price gaps happen from one suburb to the next.

But few of us have ever considered calling up two local clinics to price compare services.

You might make the argument that, for a service like a mammogram, you want to see your provider who you’ve built rapport with and feel comfortable around while she’s smushing your boob like a pancake. And that’s fine.

But what about needing an MRI? That’s not done by your regular provider anyway. Yet the price of an MRI can be anywhere from $400 to $12,000.

And again, this discrepancy can be seen in clinics that are close to your own home. You might drive 30 miles north and find a clinic that charges $4,000 for an MRI, while a clinic 30 miles south charges $2,000.

This is why it’s so important to negotiate a medical bill. You’re not getting a fair price to begin with, so you need to take fairness into your own hands.

How to Negotiate a Medical Bill: 3 Easy Steps

Aside from preemptively price comparing medical services, negotiating your rate is the best way to get a fair price for treatment.

To negotiate medical bills, there are 3 fairly simple things you gotta do:

- Make sure your bill is correct,

- Check insurance coverage (if you have it), and

- Negotiate the medical bill

You can negotiate almost any medical bill.

In my experience, hospital bills are the easiest to negotiate, but you can negotiate clinic visits, as well. And yes, even after insurance has paid on the balance, you can still negotiate.

That’s what I did when negotiating my hospital bill after I gave birth to my son. If you’re not planning on giving birth any time soon, don’t fret – this sequence works with any hospital stay or procedure.

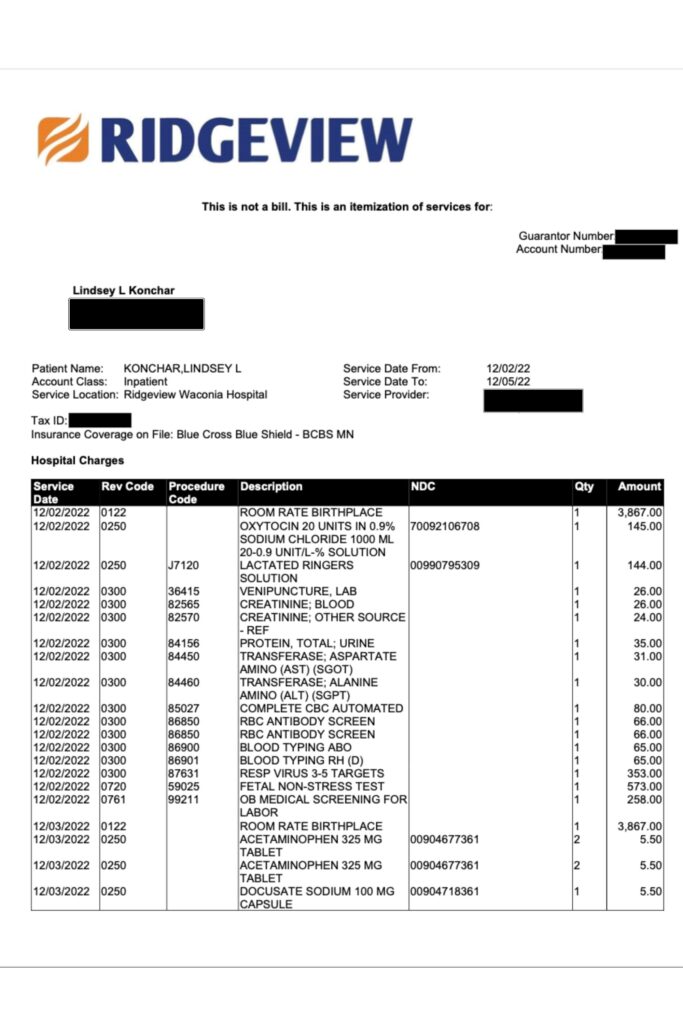

Koko was born on December 3rd, 2022.

His birth was honestly incredible (unlike his older sister’s). Pure joy ran through us as we had the final piece to our family puzzle. We were elated.

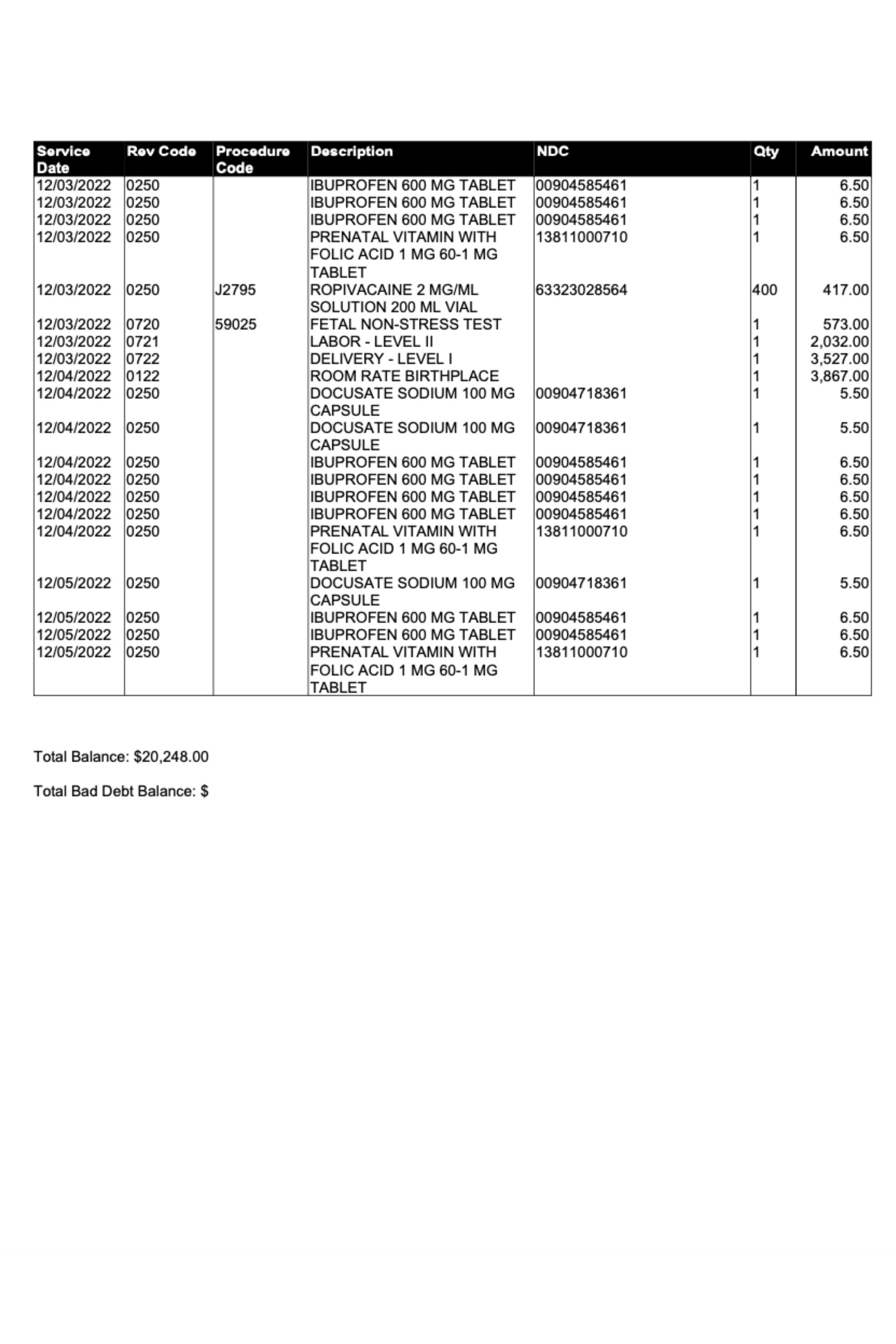

Then, a month later, the hospital bill arrived. It said we owed a whopping $20,248.00.

I knew that couldn’t be right…

And it wasn’t.

Step 1: Make Sure the Medical Bill is Correct

That’s why the very first step of negotiating a medical bill is to check that the bill is correct.

When you get a medical bill in the mail, it’s often very vague. It generally just tells you how much you owe, but it doesn’t list out every service you received.

You’ll know it’s not the full, itemized bill if you don’t see any CPT codes listed on the bill.

CPT Codes are five-digit codes that act as identifiers for medical procedures – similar to a barcode for an item at a store.

If your hospital bill does not have CPT codes listed, call — yes, pick up the phone — and ask the hospital’s billing office for an “itemized statement with CPT codes.”

Once you get the itemized statement, obviously, you won’t know what the 5-digit codes mean.

So, to Google you go.

I once heard of a family looking through their itemized bill and found CPT code 54150, which is the medical code for circumcision. Fine, except the new baby was a girl…

This is why you check your medical bill for accuracy. Up to 80% of hospital bills are billed incorrectly. Let me say that again: UP TO 80% OF HOSPITAL BILLS ARE BILLED INCORRECTLY!

So when you get that new itemized statement, your money date with yourself for that week is to sit down with your medical bill and simply Google search “CPT code XXXXX.”

This is my entire itemized hospital bill.

You can see how I was charged for birthing a human in America. – including my $6.50 for every ibuprofen that was given to me, totaling $78.00 for 12 ibuprofen tablets.

If there are any codes that don’t seem right, call and have them correct the mistake.

You can say something like, “I noticed a CPT Code 59510, which I happen to know is for a Cesarean birth, but I gave birth via a vaginal delivery, who can help me with making this correction?” – Yes, this example really happens.

You don’t have to be a full blown expert on CPT codes. Obviously, if your procedure is for a colonoscopy, but during your Google search you see CPT codes for an appendectomy show up, call and inquire.

If you’re not sure about some of the codes, you can always call and ask the hospital’s billing department or medical records department to explain what the codes mean.

Step 2: Check Insurance Coverage

Once your CPT codes are checked, you can confidently move on to step two: checking insurance coverage. If you have insurance, make sure they were billed properly AND that they paid on your bill.

In the example of Koko’s birth, this was the red flag for us. Our insurance had not been billed properly for my delivery.

After seeing a more than $20,000 bill show up, I figured something didn’t get paid by my insurance.

I called to ask the hospital about it and the woman quickly realized there was a mistake when typing in my insurer’s group number. She made the fix and resubmitted the claim to my insurance company.

You can also call your insurance company with any questions about your bill.

In my experience, insurance company’s customer service representatives are very helpful. During this process, they, too, want to be sure the money-hungry hospitals aren’t screwing them over. (#America)

Once you have your final itemized bill, and you know it’s been billed to your insurance company correctly, and insurance has paid on the bill, it’s time to move on to the third and final step: negotiating your medical bill

Step 3: Negotiate the Medical Bill

When your final bill arrives, you get to call the billing office again and ask this specific question:

“I see my total bill for my procedure on (date – fill in the blank), is for ($ – fill in the blank). My family has been under some financial stress, and we can’t pay that. What is your pay-in-full cash discount?”

(Be honest and kind – kindness goes a long way!)

They will respond by saying one of three things:

- Since your claim went through insurance we don’t have any further discounts available. We can make a no-interest payment plan with you to meet your financial needs.

- You can fill out our financial aid form, and see if that helps you.

- Yes, it looks like if you pay in-full today, we can take 10% off the total balance.

Now you get to decide how to proceed…

When I call and negotiate my medical bills, and the person on the other end of the phone responds with 1 or 2, I’d say something like, “I’ll think about it. Thanks for your help.” And hang up.

Then, I wait a day or two and call again. You’ll likely get a different representative and start over with that exact same question.

“I see my total bill for my procedure on (date – fill in the blank), is for ($ – fill in the blank). My family has been under some financial stress, and we can’t pay that. What is your pay-in-full cash discount?”

If you still don’t get anywhere, try again in a few days or ask to speak to a manager.

In my experience, negotiating medical bills with a manager is far more likely to get the job done.

If, however, they responded with 3, you can take the discount and run or you can say something like, “Wow, thank you so much for being willing to help. I can’t quite do ($ fill in the blank), but I can cover ($ fill in the blank). Then wait for their response.

One of the BIGGEST mistakes people make while negotiating is talking too much. Ask your question, then stop talking.

This is what it looked like for my son’s birth:

Me: I see my total bill for my delivery on 12/03/22, is for $2,470. My family has been under some financial stress, and we can’t pay that. What is your pay-in-full cash discount?

Them: Oh, I’m sorry to hear that. Let me see how I can help. (Wait, click, click, click.) Yeah, it looks like, if you’re able to pay in-full today, I can give you a 10% discount, making your total $2,223.

Me: Wow, thank you so much. I really appreciate your willingness to help. We still can’t quite make that work, but we can pay $1,975 today.

Them: Let me see if that’ll work for us. (Wait, click, click, click.) Yes, it looks like we can accept that!

And just like that I saved our family almost $500!

Here‘s the kicker: With negotiating these bills, you’ll likely need to pay the total amount in-full.

If you cannot pay the full amount, then you can certainly fill out the financial aid form or you can take the no-interest payment plan.

Make that monthly payment as low as possible – even just $20/month. It’ll take you forever to pay-off, but who cares? It’s interest free!

Something to be aware of is just how long this process can take. It may take weeks or even many months, especially if the hospital needs to change CPT Codes, then resubmit the claim to your insurance company, and so on.

Don’t panic if it doesn’t feel like it’s going very fast – that’s very normal in the medical world.

How to Negotiate Medical Bills in Collections

If you have medical bills in collections, you can also negotiate that, too, using the same strategy.

The reason hospitals and other facilities are so willing to negotiate your medical debt is because they’re terrified of debt collectors.

Collection agencies pay hospitals as little as 4 cents on the dollar for unpaid medical bills.

That means, if you have a hospital bill for $1,000 and it goes to a collections agency. That collections agency is paying the hospital as little as $40 for that bill.

Then, the debt collector unabashedly hounds you to pay that debt in-full. If you pay that $1,000 debt in-full to the collections agency, they profit 2500%.

This is why the hospitals are so very willing to give you a pay-in-full cash discount.

If it’s between you paying 80% of your bill or the collections agency paying 4% of the bill, who do you think they’d rather work with? The hospitals lose their ass on bills that go into collections.

Start by saying, “I see my total bill on (date – fill in the blank), is for ($ – fill in the blank). My family has been under some financial stress, and we can’t pay that. What is your pay-in-full cash discount?”

Again, be kind. The debt collector is just the middleman in this scenario. Generally they are very willing to work with you on making a fair negotiation.

The Wrap Up: How to Negotiate Medical Bills

Negotiating medical bills is something anyone can do.

Sure, negotiations might be intimidating, but remember to think of it as mutually beneficial to you and the medical provider, especially as they’d rather you pay 80% of the bill than a collections agency paying as low as 4% of the bill.

I negotiate all my medical bills, using this exact script.

But there is one thing I didn’t say that is worth mentioning in regards to negotiating medical bills.

And that is the emotional toll medical bills can take on a person. There are a variety of ways this shows up, but I’ll briefly tell you the story of the medical bill I didn’t negotiate.

At the beginning of 2022, I suffered a miscarriage or at least what we thought was a miscarriage. I was on vacation in Door County, elated to be pregnant with baby number 2, only to wake up on Saturday morning with a bit of blood in my urine.

I called the on-call midwife, and she gently suggested I go to the local emergency room. A few hours later, AJ and I got the news that there was no baby.

A few days later, when we were back home, I had a follow up with my midwife. They ran some of their own tests and ultrasounds. My HCG levels were still high, indicating this wasn’t a true miscarriage; it was an ectopic pregnancy.

The ultrasound was inconclusive, but after going to the doctor daily to get my HCG levels checked, they determined I was at risk for my fallopian tube to rupture.

At the end of the week, I went into immediate surgery, where they first performed a D&C then removed my unsalvageable fallopian tube.

I woke up feeling like a had given birth, with no baby to show for it.

I didn’t negotiate those hospital bills. Not the one from Door County Medical Center and not the one from Ridgeview Medical Center.

I couldn’t.

I did everything in my power to shove that experience deep down into a place where I never had to think about how my body had failed me and my husband. How the nurse at the medical center gave me a pin as a sad attempt to repair the heartache of losing a baby. Feeling empty and alone after experiencing that type of pregnancy. How I still don’t know if I classify it as a miscarriage or what because the baby hardly existed to begin with.

And after doing a pretty good job of locking all those feelings away in a box that I wouldn’t have to ever open again, in comes the medical bills.

I didn’t have the bandwidth to look at how the hospitals (very likely) incorrectly charged us for that horrible experience. I didn’t have the capacity to explore how much my insurance paid. And I didn’t have the ability to negotiate those medical bills.

So here’s the thing: I wish we didn’t have medical bills.

I wish people who have experienced trauma didn’t receive a bill in the mail, having to pay for the trauma they’ve endured. Whether that be an ectopic pregnancy, a horrible car accident, a cancer diagnosis and treatment, or any other number of things people go through.

First and foremost, I advocate for a better medical system in America. But because our health care system isn’t broken, it’s was made this way, we can choose to do better, for ourselves with the bills we choose to take power over and pay fairly for.

As always, I hope you enjoyed today’s episode. If you, please share it with your partner or a friend to spread the word about How to Negotiate Medical Bills and Financial Self-Care.

Now, go enjoy your day!

Read next: The Mere Exposure Effect: Why You Spend So Much Money