Coast FI: How to Semi-Retire With Coast FIRE (2024)

We are getting a little personal this post, but after polling my IG community, this is what the people wanted! So we are going to talk about Coast Fi. What is it and how we semi-retired using what’s called Coast FIRE.

You can listen to the podcast episode on Spotify, Apple Podcasts, or where ever you like to listen!

Coast FI: What is the FIRE Movement?

Let’s start by talking about what Coast FIRE is and more broadly about the FIRE Movement.

The FIRE Movement is an abbreviation or acronym for Financial Independence Retire Early. Nerd Wallet defines the FIRE Movement as, “a lifestyle movement that prioritizes extreme saving and investing in order to retire earlier than traditional methods might allow.”

The article goes on to say, “People who use FIRE to retire early do so by drastically reducing their expenses, looking for ways to increase their income, and investing the money they save in a mix of tax-advantaged accounts as well as regular brokerage accounts.”

Income minus expenses and invest the rest is the best (woah, lots of rhymes), most simplistic way I can describe the FIRE Movement.

There are varying degrees of intensity within the FIRE Movement, meaning some people have a savings rate – which should more accurately be called an investing rate – of 20%, while some strive for as high as 70%.

Often, those with the 70% investing rate go to extreme lengths to cut costs.

I’ve heard stories of people who eat food out of trash cans or dumpsters to save on grocery expenses. I’ve heard of people living in unsafe areas to save on rent. And we all know the stingy or “cheap” friend who tips poorly, making you feel obligated to cover for them by overtipping on your tab.

Let me just say, I don’t subscribe to that type of lifestyle. I think the FIRE Movement is a really interesting community and concept to explore and be aware of. They definitely have some solid educational information. But I would highly caution against taking FIRE to extreme lengths (like the ones I listed above).

Coast Fi: What are the Types of FIRE?

However, there are varying degrees of FIRE or different types of FIRE. I’ll give a high level overview of each, so you can start understanding Coast FIRE, which is what my husband and I have now reached!

Lean FIRE

Lean FIRE is the most extreme version of FIRE, usually involving a minimalist lifestyle. Someone going for Lean FIRE has probably cut costs down to bare bones everything, and is investing more than 50% of their income.

The person interested in lean FIRE likely lives on very little. We’re talking like $30,000, per year.

Fat FIRE

Fat FIRE, on the other hand, generally has a goal of investing a lot of money, and is less extreme about cutting costs. They want to live on $100,000 or more in retirement. Generally, not always, but generally they’re higher earners.

Barista FIRE vs. Coast FIRE

Barista FIRE and Coast FIRE are two really similar types of financial independence strategies. People interested in Barista FI and Coast FI don’t necessarily have a goal of never working again, they just want more freedom and flexibility about how much they work and what type of work they do.

Barista FI is more like, “I grinded it out for 10+ years in corporate America, invested a bunch of money, and now I can go work in a coffee shop or bookstore for the rest of my life, happily living on a part-time income.”

Coast FI is very similar to that, except people in Coast FI may not leave their job, but instead will coast into retirement.

My husband and I technically fall into the both/and category of Barista FI and Coast FI.

AJ did leave his job and might work part-time, if he wants. I have my own business, and of course, did not leave my job. In fact, I’ll be taking more financial therapy clients now that I have the time to do so.

Essentially, we never had to put another penny into our retirement savings, and we will coast into retirement very comfortably at 65, and likely even sooner than that.

That’s all the foundational stuff of the FIRE Movement, but you guys wanted to know our story.

Coast Fi: Semi-Retirement Using Coast FIRE

If you follow me on Instagram, you might have seen that at 32 & 34 years old, my husband and I are now semi-retired.

A couple weeks ago, using a wrench, my husband popped a bottle of champagne and we toasted to our new beginning! Some people are completely stoked for us and other people are like what the heck does that even mean?!

And it’s a fair question.

JL Collin, a man often referred to as The Godfather of Financial Independence, says in his book The Simple Path to Wealth, “There are many things money can buy, but the most valuable of all is freedom. Freedom to do what you want and to work for whom you respect.”

We happen to agree with this sentiment, especially as parents of two small kids.

For us, Coast FI or being semi-retired means we:

- Don’t have to put another cent into our retirement investments, and will still very comfortably fully-retire at age 65

- Never have to work grueling, soul-sucking jobs ever again

- Can work part-time for the next 30 or so years

- Are happy and content with the things we have in our life

- Will have more time together as a family to do what we want, when we want.

After 9 years on the corporate hamster wheel, AJ quit his job. He might pick up some contract work if the project seems fun for him, but he doesn’t have to because my business as a financial therapist will completely sustain our little family of four by seeing 12-15 therapy clients per week. Plus, I get to blog and podcast, which is super fun for me!

Now, of course, we have two small kids. They’re one and a half and nearly four. So, AJ is certainly hanging with them while I’m working and visa versa. And I don’t want to diminish the importance of that.

Being a parent is no small job, and I’d be the last to minimize the work of unpaid parental labor.

I will say, the one thing I am absolutely loving about our new life, though, is we literally don’t have weekends.

I’ve always loved the idea of having my own schedule. Like, I used to work at an inpatient psychiatric hospital, which was open 24/7. And it never bothered me to work weekends because I love the idea of having a random Tuesday off.

I can go grocery shopping when the stores aren’t so busy or go to a yoga class in the middle of the day. My family can go on a hike on Wednesday mornings rather than Saturdays when the trails are packed. Whatever.

Now, we can flex our hours however we want to fit into our schedule, which is pretty great.

So, the question I keep getting is how did you do it?! And that’s what I’m here to tell you about.

To get the whole picture, I think it’s really important for you to understand the timeline of this. Because there are few things I hate more than seeing the glitz and the glam highlighted on social media, without the true context of a person’s life or situation.

2016

For us, it started 8 years ago. AJ and I had only been dating for a few months at the time.

I was working essentially two full-time jobs (one at a psych hospital and the other at a dental office) and had just gotten back from a 2-week summer Eurotrip, visiting my friend who was in graduate school in London at the time.

AJ was living at his parents house, while saving for a down payment on a house and for a new truck.

If we were to classify the two of us, you could say I was a spontaneous spender and he was a diligent saver. We definitely approached money very, very differently.

In December of 2016, he bought a house. At that point, we had been dating for 10-months, but within the first 6-weeks of knowing each other, we knew we were end game.

So we moved in together in to our 1,200 square foot house, and split the cost of the monthly mortgage. Like most young couples, we said the house was our “starter home” and we would find something bigger and nicer in about 5 years.

I wish I could tell you that we started getting really serious about our money back then (in 2016), but the truth is we didn’t.

2018

Nearly two years went by, and AJ and I got engaged. Throughout that time, AJ was working in his corporate job, and I was working my two jobs. Both of us were contributing to our 401(k)s, but certainly not aggressively putting money away for retirement.

We lived within our means, though we didn’t really know what that meant yet, and we were traveling quite a bit, going out, and saving for our wedding.

2019

Then, in 2019, everything started to shift for us.

That was the year we were getting married. We knew at that point, we would be merging our finances.

I was feeling badly because I had some student loan debt that I was bringing into our marriage and he was coming into our marriage with no student loans.

He had gone to school on a full-ride athletic scholarship. And while I had applied for and received a few grants throughout undergrad and graduate school, I was still bringing nearly $50,000 of student loans to our relationship.

We both didn’t carry any credit card debt, and had always been serious about keeping it that way.

As an aside, I had gotten into almost $6,000 of credit card debt in 2014 and felt like I was suffocating. After getting out from under that debt, I could breathe again. And I promised myself I would never go back into credit card debt.

I say that so, if you’re listening to this and you’re in credit card debt, know that you can get out from under that debt and stay out of it. It’s been nearly 10 years for me, and I’ve never gone back into high-interest debt.

It’s also really important to note that high-interest debt is the demise of your ability to invest for retirement. I’ve mentioned this in previous episodes, but anything over 7% is considered high-interest, and you want that debt gone. A BIG reason we were able to invest so much is because we had no credit card debt.

If you carry credit card debt, that’s the first thing to focus on getting rid of. You can grab my Intentional Spending Planner, which has a Get Out of Debt Planner in it for only $9.89 on Etsy. It will help you lay out and organize your debt so you can start climbing your way out of it. The Intentional Spending Planner is linked in the show notes.

Back to the story.

It’s 2019 the wedding comes and goes, and we officially change my name and merge our money. This was only five years ago. It was also the time I decided we needed to figure out how to do money.

We were living a comfortable lifestyle, but we wanted to start family planning. Which was definitely a big motivator for us. AJ was working 50-60 hour weeks and would have had more of a relationship with his coworkers than with our kids.

I guess you could say we knew what we wanted, but didn’t know how to get there. And actually, if I’m being really honest. I always knew in my bones that there was another way. AJ did not.

It took years for him to see that this was actually going to be possible for us. I’ll explain more about that towards the end of our story.

But like I said, I didn’t really know where to start, so I turned to Google. Of course, Dave Ramsey’s Total Money Makeover came up, and I bought the audiobook.

I don’t really like the guy’s approach, but it was where we started. If I had known then what I know now, the two books I recommend you start with are: Your Money or Your Life by Vicki Robin & Joe Dominguez and I Will Teach You to Be Rich by Ramit Sethi. The books are like $10 each and well worth every penny. They’re also linked in the shownotes.

Anyway, I listened to Total Money Makeover, and I was hooked on money education. I wanted to read everything I could about money and how it plays a role in my life and in my marriage.

That was the moment I decided to really take control of my finances. AJ was less gung-ho about the whole thing. He was on board, like, willing to listen to my suggestions, but he definitely was not going to be reading the books and listening to the podcasts like I was.

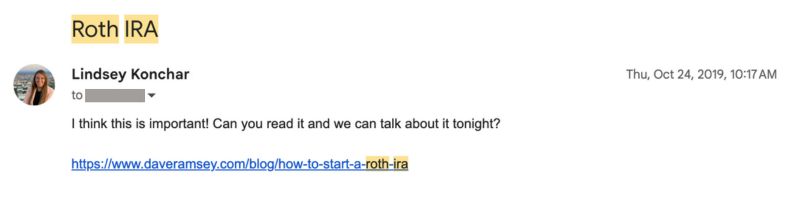

In fact, I have an email that I sent to AJ from October 24th, 2019 titled, “Roth IRA” and the message reads: “I think this is important! Can you read it and we can talk about it tonight?” with a link to an article about Roth IRAs.

He did not respond to my email, but I opened my Roth IRA very shortly after that.

In that same year, I got word that we were getting money from my grandma. She had passed away and was leaving me and my brother an inheritance.

It became vitally important to me to not disrespect my grandparent’s money, and do something smart with any funds that were gifted to me. I had heard about people blowing through lottery winnings or inheritances before, and it kind of terrified me.

I was, let’s say, half smart with the money. In 2019, I received about $100K, which I used to immediately pay off the rest of my student loans. That was about $50,000. Then, I bought my car, a new 2020 Subaru Ascent, which cost the other $50K.

Again, if I knew then what I know now, I wouldn’t have bought a brand new car. What I will say is I plan to drive my car until the wheels fall off.

So, not the worst thing I could have done, but certainly not the best. The best thing I could have done would have been to take my time, find a low mileage, used car, and invest the rest of the money. But alas, live and learn.

Let me take a minute here to acknowledge how privileged this part is. To receive $100,000 in one year, wipe away $50K of student loan debt and to be able to drive a nice, safe car is hugely helpful and stress-reducing. I know that, and I’m grateful for that.

And while it’s something I’ve worked through, there’s a weird amount of shame that comes with this type of privilege. Like somehow I’m unworthy or undeserving of receiving money from my grandma.

Yet it’s kind of ass-backwards because most people hope they can give their kids or grandkids money when they’re older. Most people I talk to want to help put their kids through college or help pay for a wedding or a downpayment on a house. But quickly scoffs and says, “must be nice,” when someone in their life gets an inheritance.

Like with everything involving finances, people have conflicting feelings about it all. What I will say is this: I feel massively proud of the choices AJ and I have continued to make with our money – both gifted and earned.

So at this point of our life, it’s the beginning of 2020, and we:

- Still living in our 1,200 square foot “starter home”

- Have no credit card debt

- Don’t have student loans (AJ getting the full-ride and us choosing to pay off all mine with my inheritance)

- Own two paid off cars (AJ buying his outright in 2016 and us buying mine with my inheritance in 2019)

I’m getting more and more pumped about running calculations. AJ is, well, along for the ride.

2020

In January of 2020. I was on a flight to New York, visiting a couple friends out there, and I ran some numbers. I vividly remember this moment because it actually felt life-changing for me.

It’s the moment I realized how crazy home ownership is. Maybe more accurately, how homeownership and amortization (or pay-off schedules) work.

On that plane, I actually sent this EXACT text – yes, I still have it – to AJ. It said:

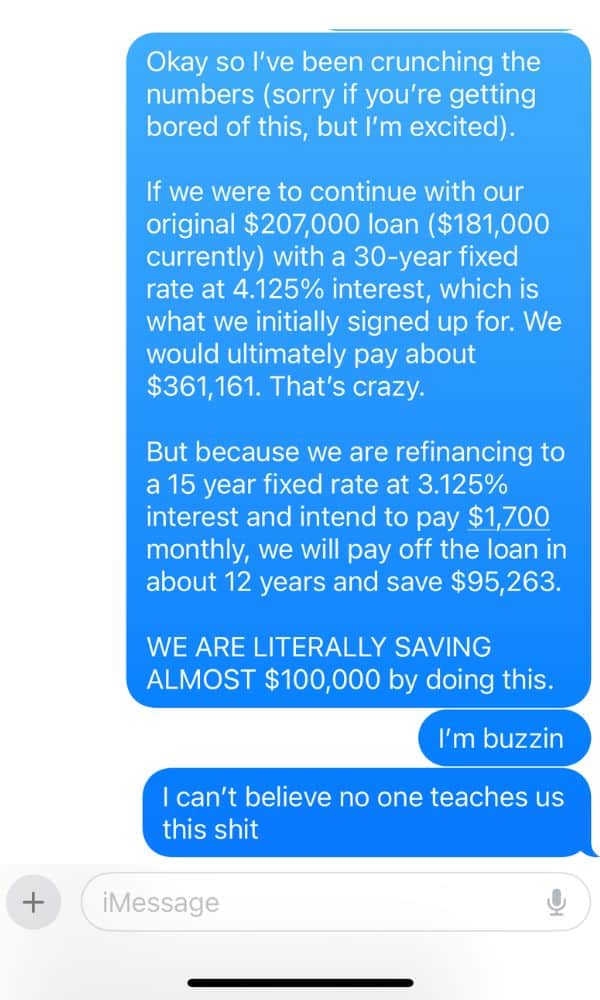

Okay, so I’ve been crunching the numbers (sorry if you’re getting bored of this, but I’m excited).

If we were to continue with our original $207,000 loan [which was a typo, it was $208,000] ($181,000 currently) with a 30-year fixed rate at 4.125% interest, which is what we initially signed up for. We would ultimately pay about $361,161. That’s crazy.

But because we are refinancing to a 15 year fixed rate at 3.125% interest and intend to pay $1,700 monthly, we will pay off the loan in about 12 years and save $95,263.

WE ARE LITERALLY SAVING ALMOST $100,000 by doing this.

That text was followed up with. “I’m buzzing.” and “I can’t believe no one teaches us this shit”

You guys, my dad is a realtor. He sold homes for a living, and I still had no idea *just* how much homeownership impacts your day-to-day finances. So let me take some time to educate you on a topic I wish I had been educated on.

What ended up happening is, the pandemic hit two months later. And instead of refinancing to a 15 year fixed loan with an interest rate of 3.125%, we got an even better rate of 2.25%. Making our monthly payment go from the original $1,300 for 30 years to $1,600 per month for 15 years AND saving us almost $120,000 in interest.

We’ve kept our monthly housing costs under 16% of our gross pay. At one point, our housing costs were less than 10% of our gross monthly income.

Remember from the last post, Adulting 101: Personal Finance Tips Your NEED to Know, the recommended housing costs are under 28% of your gross income.

Instead of falling prey to lifestyle creep and upgrading to a new, bigger house, we’ve made the choice to keep our housing costs low and invest the difference.

At the beginning of the post, I mentioned people who are living in unsafe environments just to keep their expenses low. Let me assure you, that is not what we’re doing.

We actually love our house, its location, and the city we live in. Sure, there are a few things we would change about it, and there are a few things we have changed about it – like adding a third bedroom in the basement.

But a long time ago, we decided our freedom was more important than more square footage that, frankly, we just don’t need.

Why is all of this so important? Why am I telling you about my housing costs when you want to know how we semi-retired in our early 30’s?

The answer is two-fold:

One, because we kept this giant expense low, we were able to invest what we would have been spending on a more expensive house.

And two, because when you are trying to get your finances in order, you will be tempted to cut spending on small things. Small things like grabbing Chipotle for lunch or periodically buying Starbucks on the way to work or while grocery shopping with your kids.

Which is all fine to do, but the biggest impact on your money is going to be the BIG financial decisions you’re making. Your housing costs, transportation costs, interest rates, and your financial advisory fees are all going to have a wayyy bigger impact on your ability to invest than your $6 latte everyday.

For perspective – and because you know I love a good numbers crunch – I’m going to give you a breakdown of how the numbers have shaped up for paying more attention to our housing costs, rather than the price of my $7 Starbucks.

After we refi’d to a 15 year loan with a 2.25% interest rate, we will only pay about $33,000 in interest rather than the original $153,000 of interest over the life of our loan.

Making our all-in number about $241,000 on our house and saving us nearly $120,000 just in interest.

But, what if I hadn’t learned all that? What if we decided to move to a bigger house and kept a traditional 30-year loan?

What if AJ and I had convinced ourselves that our house was indeed a starter home, and that we needed to upgrade to a bigger house in March of 2020, rather than simply staying in our house and refinancing for a 15-year fixed loan?

Going with the average housing cost in Minnesota of $355,000 and, to keep it consistent we’ll assume the average interest rate in March 2020 which was 3.5%, we would have spent almost $574,000 over 30-years.

That means, by staying in our house, we are saving approximately $333,000.

Now, I buy Starbucks about 5 times per month, but for sake of ease, let’s say I spend $7 every week on Starbucks. That means I spend $364 on Starbucks every year.

If I chose to focus on my smaller spending decisions and cut out my beloved weekly Starbucks, over the course of 30 years, like the life of the comparable housing loan, I would have saved $11,000.

I’m not saying paying attention to your daily spending isn’t important. Of course it is. Intentional spending is the hill I will die on.

But if you really want to semi-retire or even retire early, like 55 years old rather than at 65 or 70, you have to look at your big expenses and how they’re impacting your big life goals.

Coast FI: Increasing Income

Obviously, keeping our housing costs very low has given us wiggle room on how we want to do the rest of life. But the next important decision we made was increasing our income.

AJ started at his company as a graphic designer. He is really good at what he does and watching him design was so fun. But after working as a designer for 4 years, he had an opportunity to transition into management.

Becoming a manager meant designing less and, well, managing more. He knew he wouldn’t like the work as well, but staying a designer would have meant staying at a far lower salary.

We hemmed and hawed on that for a while because I truly believe in living a life you love today while saving for future you, but ultimately decided we needed to increase his salary.

He made the jump and his salary started to go up. And here’s a really important part of all of this. His salary went up, but our living expenses stayed the same.

Sure, we celebrated his various promotions with a dinner out at our favorite, local restaurant. But we didn’t move into a bigger house, we didn’t upgrade our cars. We didn’t take a massive vacation. Instead, we increased our investments.

Wanting a bigger house or a fancier car isn’t bad. They’re great, if that’s what you want. But we knew, that’s not what we wanted.

Together, we decided we wanted freedom – more than we wanted to upgrade our lifestyle. Every pay increase we had, every bonus, and every influx of cash we got, went primarily into investments.

To put numbers to this: At the beginning of 2020, we were contributing about $600 per month to investments. By the time AJ left his job last month, we were contributing over $4,000 to our investment accounts each month.

Increase income, reduce expenses, invest the rest.

Okay, so far, to reach Coast FIRE, we’ve started investment accounts at 27 years old, kept housing costs extremely low, increased our salary, didn’t let lifestyle creep take hold, and increased investment contributions dramatically.

Coast FI: Childcare Costs

Then, in February of 2020, I found out I was pregnant, and we all know what happened next. A month after finding out I was pregnant, the pesky pandemic hit us all like a semi truck.

At that time, I was working at a Federally Qualified Health Center, earning $46,000 gross. After taxes and deductions, I was bringing home $32,000 per year.

The average cost of childcare for one kid in my county is about $16,000 per year. We knew we wanted more than one kid. And as you probably gathered, two kids in childcare would have cost the same as my salary. Thank you, America.

I was furloughed from my job in March 2020, and being pregnant and high-risk, never went back. Our income took a pretty big hit, but because it was pandemic times, so did our expenses.

I have fond memories of AJ and I curling up in the living room watching hours of Game of Thrones. Not exactly a high-cost activity.

Luckily, in part because we had kept our housing costs so low and AJ was increasing his salary, we were able to make this transition fairly easily.

Coast FI: Starting a Business

For me, though, perhaps the most important part of this pivot isn’t the ridiculousness of childcare costs, but this is really the time when my entrepreneurial spirit began to shine.

I knew I wanted to be home with my babies. But despite my original thinking, being a mom wasn’t going to be my sole purpose in life.

I thought being a Ballerina Farms mama would be easy, but I quickly learned that being a full-time stay-at-home mom was not the dreamy, cushy life my childless self thought it was going to be.

I love my babies, of course, but I also needed something that was strictly for me.

After experiencing deep postpartum anxiety for 9 months, I decided to make a change. That’s when I started learning again.

And not just learning how to make homemade jam and what Montessori toys were best for my baby’s development. I learned all kinds of things for me.

From taking a blogging course, and now understanding SEO to learning how to write and publish a book, which I did in July of 2022.

There have been many pivots within my business. Initially, I thought I wanted to help moms with postpartum anxiety – an area that is sorely lacking. Then, I tried full-time blogging, and I enjoy blogging, but not full-time.

2022

In October of 2022, when I was 34 weeks pregnant with my son, I went to my first self-development conference.

At that event, I was desperately trying to find my entrepreneurial path. During one of the sessions, I vividly remember thinking, “I want to help people with their money, but who would want help from a therapist.”

Turns out a lot of people.

2023

In April of 2023, I was listening to an audiobook titled: “How Not to Hate Your Husband After Kids.” It was pretty funny, and a good read for postpartum moms. But in that book, the author mutters the words “Financial Therapist.”

I was driving back home from running some errands, and as soon as I heard those words, I paused the book. I didn’t know what a financial therapist was, but I knew I needed to find out.

As soon as I stepped through the door, I Googled: Financial Therapist.

As it turns out, because I’m a licensed therapist, I qualified for the certification. I bought the program, and voila. Not even a month later, I was officially on my way to running my own financial therapy and coaching business.

That was a year and a half ago. For a year and a half a full-time mom’d and financial therapy’d during naps, nights, and weekends. The first month of seeing clients, I made $625. And guess where it all went? Right into my Roth IRA.

Increase income, reduce expenses, invest the rest.

For the last year and a half, we’ve been building our runway. We lived off of AJ’s salary, and we invested almost all of my salary.

2024

To be honest, it all happened quicker than we were expecting. It wasn’t even until the beginning of this year did I finally convince AJ that this can work. But the numbers spoke for themselves.

Using an investment calculator,I was able to show AJ that, although returns aren’t guaranteed (I have to say that as a disclaimer because I’m not a financial advisor. I’m a financial therapist and this is for educational purposes only), we are likely to have well over 5 million dollars by the time AJ turns 65 years old.

And that’s if we don’t contribute another penny to our investments.

According to a retirement calculator, based on our current income and expenses, we only need 2.4 million dollars to retire comfortably.

The Wrap Up: Coast Fi

Here’s the thing with a lot of people involved in the FIRE Movement: They just want more, more, more, and they genuinely feel like there’s’ never enough.

I didn’t want to be one of those people.

I wanted to know when we should put our foot on the gas and when we could hit the breaks.

Because I’m not saying we’ll never invest for retirement again.

I’m saying, let’s slow down a little bit during this season of life. While our kids are little and we don’t get this time with them again. Let’s pour more time and energy into my business and my clients. A career I love rather than working for someone else’s dream. Let’s enjoy our life now, while our bodies are young and healthy.

I wouldn’t say we went to extreme lengths to achieve Coast FI, but we made really intentional choices along the way.

We stayed out of high-interest debt, increased our incomes, kept expenses intentionally (and relatively) low, and we invested the difference.

We worked really hard to learn delayed gratification, avoid comparisonitis, and not give a sh*t about keeping up with the Joneses, the Kardashians, or anyone else.

For 5 years, we practiced, failed, learned, explored, grew, and now for the next 60+ years of our life, we get to coast.